Rent Increases Are Higher When Long-Term Tenants Move Out

Posted on July 3, 2025

When a tenant moves out of a property, it often gives landlords a chance to adjust the rent to reflect current market conditions. But how much does the rent typically increase—and does it depend on how long the previous tenant stayed?

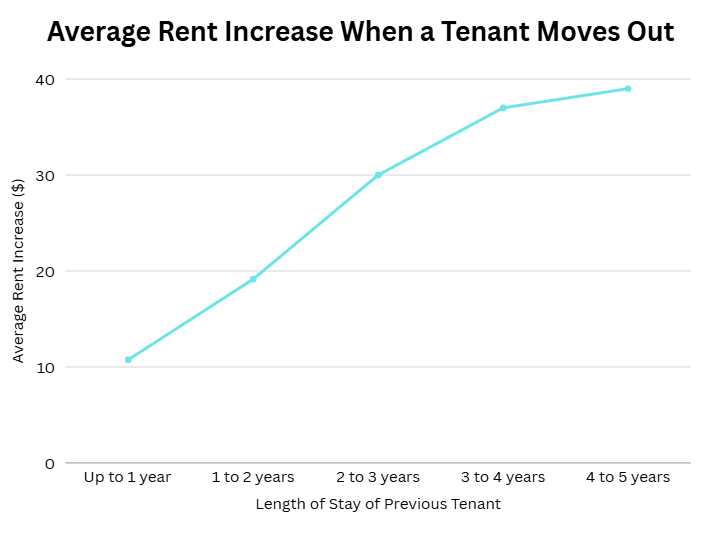

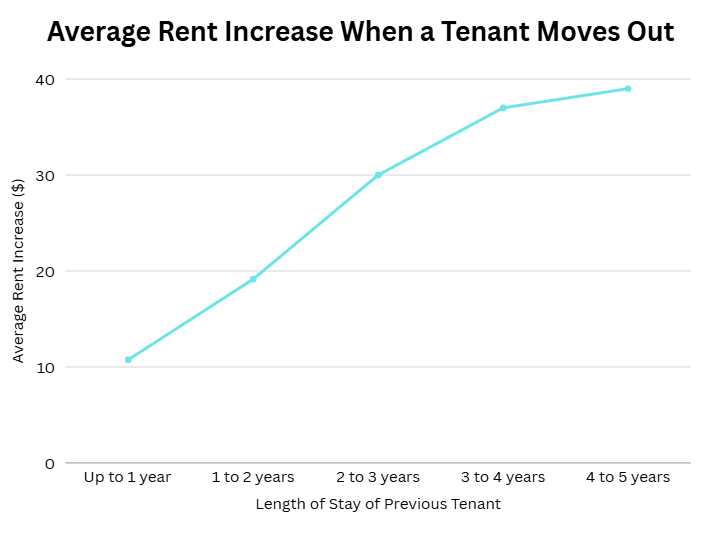

The answer is yes. Analysis of over 10 years of New Zealand rental data from the RentHQ property management software system shows a clear trend: the longer a tenant stays in a property, the larger the rent increase tends to be for the next tenant.

As the graph shows, if a tenant stays for less than a year, the average rent increase for the next tenant is just over $10. But if they’ve been there for 4 to 5 years, the average increase jumps to nearly $39. That’s a significant difference.

Many landlords choose to keep rent increases moderate for existing tenants to reduce turnover and maintain a stable income stream. However, market rents often rise over time. When a long-term tenant moves out, landlords often take the opportunity to reset the rent closer to market rates. The longer the tenancy, the more out-of-date the rent is likely to be—hence the larger jump.

For property managers and landlords, understanding this pattern can help with financial planning and rental yield forecasting. It also reinforces the value of tenant retention, balanced against the potential for a rent reset.

For tenants, it’s a reminder that long-term renters often enjoy below-market rents, while new tenants may face steep increases—especially if the previous occupant stayed for several years.

Note: These insights are based on anonymised rental data collected across New Zealand using the RentHQ property management software system.

The answer is yes. Analysis of over 10 years of New Zealand rental data from the RentHQ property management software system shows a clear trend: the longer a tenant stays in a property, the larger the rent increase tends to be for the next tenant.

As the graph shows, if a tenant stays for less than a year, the average rent increase for the next tenant is just over $10. But if they’ve been there for 4 to 5 years, the average increase jumps to nearly $39. That’s a significant difference.

Why This Happens

Many landlords choose to keep rent increases moderate for existing tenants to reduce turnover and maintain a stable income stream. However, market rents often rise over time. When a long-term tenant moves out, landlords often take the opportunity to reset the rent closer to market rates. The longer the tenancy, the more out-of-date the rent is likely to be—hence the larger jump.

Why It Matters

For property managers and landlords, understanding this pattern can help with financial planning and rental yield forecasting. It also reinforces the value of tenant retention, balanced against the potential for a rent reset.

For tenants, it’s a reminder that long-term renters often enjoy below-market rents, while new tenants may face steep increases—especially if the previous occupant stayed for several years.

Note: These insights are based on anonymised rental data collected across New Zealand using the RentHQ property management software system.

- November 2025

- October 2025

- August 2025

- July 2025

- June 2025

- May 2025

- January 2025

- December 2024

- November 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- January 2023

- December 2022

- November 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- August 2021

- July 2021

- May 2021

- February 2021

- January 2021

- September 2020

- August 2020

- July 2020

- May 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- January 2019

- December 2018

- October 2018

- September 2018

- August 2018

- June 2018

- May 2018

- April 2018

- February 2018

- January 2018

- December 2017

- November 2017

- September 2017

- August 2017

- May 2017

- April 2017

- March 2017

- February 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- January 2016

- October 2015

- September 2015

- August 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- September 2011

- July 2011

- February 2011

- January 2011